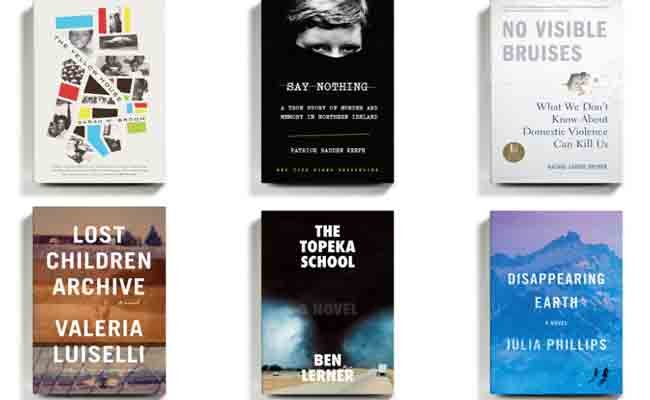

Best VW T Roc Reviews 2023 – Is It Worth Buying A VW T-Roc?

May 27, 2023

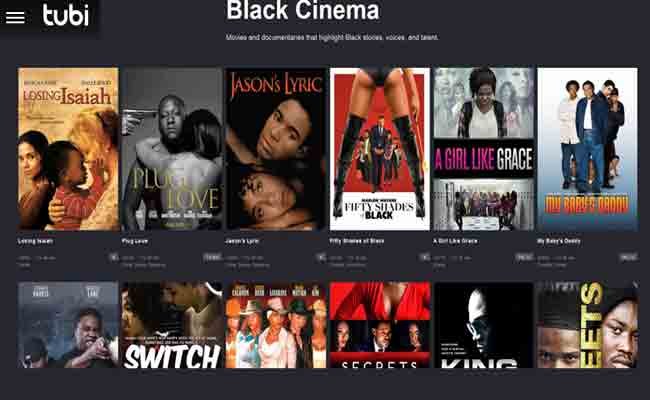

Best Tubi Reviews 2023 – What Is Tubi Login Method?

May 31, 2023Hello Friends, how are you all? Today’s topic is Best Chime Reviews 2023 – Chime Login Method – What Is Chime? Chime is a mobile-only app with free checking and savings accounts. It offers features that you won’t find at most online banks. Such as early direct deposit and fee-free overdraft protection.

The company is part of a new group of “neo banks” that cater to low- and moderate-income customers. They don’t use screening tools like those used by traditional banks to block accounts. So they can be an option for people with problems opening bank accounts.

Best Chime Reviews 2023 – Chime Login Method – What Is Chime?

Costs

Chime is a famous online bank that offers several accounts and services, including checking and savings. Its products are targeted at the consumer who’s looking for a simple and low-cost option. That doesn’t include monthly fees or overdraft charges.

However, the company’s lack of a physical branch network can be an issue for some customers who need one-on-one assistance. Plus, the fees for out-of-network ATM usage and cash deposits may turn off some consumers.

Chime offers a checking and savings account with an industry-leading 2.00% APY (annual percentage yield). Which is more than double the average savings rate at traditional banks. The company also offers two automatic savings features, “Round Ups” and “SpotMe,” to help you save more.

Features

Chime offers several digital personal finance services that do not require visiting a physical bank. Instead, you can use the Chime app to check your balances and transaction history. Set up automatic savings tools. And even transfer money between your checking and savings accounts.

Unlike many online banks. Chime charges no monthly fees. And provides free overdraft protection through its SpotMe service—customers who receive at least one direct deposit of $200 or more monthly. And have a positive account balance and are eligible for $200 in free overdrafts.

In addition to this, the company also offers automated savings tools. That allows you to automatically round up your debit card purchases to the nearest dollar and put the change in your savings account.

If you want to build credit, Chime also offers a secured credit card with no annual fee. It also provides a Safer Credit Builder feature. That transfers your payments toward your account on time each month. And reports them to the major credit bureaus.

Customer Service

Chime is a bank that offers checking and savings accounts and one credit card. Its checking account is available for free. And there are no monthly fees or minimum balance requirements.

Its credit cards are also low-fee if you want to build your credit history or start a new one. It also doesn’t use Chex Systems to screen its customers, which is excellent for people who have an account of bad financial decisions and need a second chance at banking.

The customer service team at Chime is accommodating. They offer multiple ways to reach them. They respond to phone calls and emails. And provide step-by-step guides to help you navigate common issues.

It’s best to contact Chime before you have an issue so that you can resolve it quickly. Their customer support is available to help with all sorts of topics, including app problems, overcharges, missing cards, and more.

Overall Rating

- Chime is an online-only banking services provider that doesn’t have physical branches. But its app is intuitive and provides all the functionality of a traditional bank from your mobile device.

- It also has no foreign transaction fees, a big plus for those who frequently travel abroad.

- The company’s mobile app is rated 4.8 out of 5 stars on the App Store and Google Play. It offers daily account balance updates and real-time transaction alerts.

- Another prominent app feature is its ability to block debit card transactions if you lose your cards or suspect they’ve been stolen.

- You can also set up automated savings tools to help you grow your money. This makes Chime one of the best high-yield online savings accounts, especially if you have a strong credit history.

- chime login Method (write)

- chime savings account pros and cons (write)

FAQS:

What Is Chime Customer Service Number?

Chime Member Services is available to help members 24 hours a day, seven days a week. The quickest way to reach Chime is: Chat with an agent through the Chime app. Call us at +1 (844) 244-6363.

What Is Chime Routing Number?

Stride Bank, N.A. routing number: 103100195. Bancorp Bank routing number: 031101279.

How Does Chime Work?

Chime is a financial technology company. That offers no-fee checking and savings accounts, a debit card, and other consumer banking services. It is a challenger bank that competes with traditional banks in many critical parts of consumer banking.

For example, it offers a second-chance credit card to people with bad credit history. This is a popular option for those who are turned down for bank accounts elsewhere and want a second chance at a financial life.

It also allows users to transfer money from their Chime account to an external bank account via Zelle. However, it is essential to note that this can take up to 5 business days.

Chime App Downloading Method Where To Find It?

Chime is a banking industry disruptor. That offers fee-free checking and savings accounts for budget-conscious customers. It also has a credit-building tool that helps customers build their credit history for free.

The Chime app is available for both iOS and Android. It is easy to download and use on your smartphone.

Does Chime Work With Zelle?

Chime is a financial technology company that provides fee-free online banking services. However, the company doesn’t have a bank charter. Instead, it partners with The Bancorp Bank and Stride Bank, both FDIC members.

Its service offering is as extensive as any brick-and-mortar bank. Its apps include features such as mobile check deposits, free “Pay Anyone,” peer-to-peer money transfers, an ATM locator, and more.

Unlike traditional banks. Which have to charge fees and interest to their customers, fintech companies. Zelle doesn’t charge these fees. They earn their revenue by selling additional products to their clients. They also don’t have to spend a lot of time dealing with customer complaints, so their service is fast and efficient. This makes them a good choice for people who want to get their money moving quickly.

Is Chime A Good Bank?

Chime is a digital financial technology company that partners with two banks to offer checking, savings, and debit cards. It doesn’t operate or staff branch locations and passes those cost savings on to customers. It also doesn’t charge overdraft or monthly fees and doesn’t require a minimum deposit.

Is Chime A Prepaid Card?

Chime is an online bank that offers a prepaid card, a checking account, and a savings account. Its mobile app has 150,000+ 5-star reviews and it helps you manage your money on the go.

Its prepaid cards offer an early direct deposit option, Which lets you get your paycheck two days early. But these cards are not tied to a full-service bank, Which can limit your overall banking experience.

Dose Chime Business Account Is Good?

Chime is a fully online bank, which is excellent for people who don’t want to use a traditional bank. They don’t have physical branches. They offer simple banking services with no monthly fees or minimum balance requirements.

However, Chime doesn’t have all the features you would expect from a full-service bank. For instance, they don’t offer auto loans or certificates of deposit.

They have credit builder accounts, funded by moving money from your checking account. These transactions are reported to the credit bureaus and help build your credit history.

They also offer fee-free ATM withdrawals and reimburse one ATM dishonor fee per month if you have received a direct deposit of $1 or more. In addition, they offer a SpotMe feature that won’t charge you overdraft fees for up to $200.

Is Chime Online Banking Safe?

Chime online banking is a good choice for people who want to save money. Get a better rate of interest and don’t mind paying less in fees than they would at a traditional bank. They also have an impressive mobile app. That makes it easy to receive direct deposits up to two days early, transfer funds, and find nearby ATMs.

Chime doesn’t use ChexSystems or credit reports to approve new account holders, Which can be a lifesaver for those with poor credit histories.

Unlike many traditional banks. Chime has no overdraft fees, monthly service fees, or minimum balance requirements. Even no foreign transaction fees. Its out-of-network ATM fee is $2.50. But it’s free to withdraw cash from over 60,000 ATMs in the MoneyPass and Visa Plus Alliance networks.

What Is Chime Withdrawal Limit?

The Chime withdrawal limit is the amount of money. that can be withdrawn from your Chime account at anytime. The bank sets this limit for safety and security reasons.

Also Read: Best Instacart Reviews 2023- What Is Instacart Login Method?

The Chime spending account is similar to a checking account but comes with a free Visa debit card. It also offers access to a network of ATMs and other resources for fee-free services.

Does Chime Show Pending Deposits?

Generally, pending deposits are marked in grey on the app’s main screen. The warranty is being processed and will be credited to your account soon.

How To Add Money To Chime Card?

You can easily add money to your Chime card by visiting any of Chime’s cash deposit partners. Retailers like CVS, Walmart, Walgreens, and Rite Aid are all part of this network.

Another option is to use direct deposit or a bank transfer. These methods are convenient and offer greater security than handling cash. However, they may also have fees associated with them.

Alternatively, you can deposit cash at one of the 60,000 fee-free ATMs Chime is partnered with through the MoneyPass(r) and Visa Plus Alliance networks. If you don’t know where to go, use the Chime app or website for an ATM locator.

Is Chime Mobile Check Deposit Instant?

When you make a mobile check deposit, you’ll need to snap a picture of your check using the Chime app. Then, the funds should appear in your account within five business days or less.

Suppose you’re unsure whether your check is a good candidate for mobile deposit. Chime will give you a push notification and email you with more details. However, some checks may be rejected for several reasons.

What Time Does Chime Mobile Deposit Hit?

You’ve probably heard you can get paid two days early using Chime direct deposit. But how does it work? It’s a great feature, but there are a few things you need to know about how it works.

First, your employer or benefits provider must set up direct deposit with their bank. This may take a few days.

Once that’s done, you can receive your paycheck from your employer or benefits provider directly into your Chime account.

Your direct deposit should arrive in your Chime account up to 2 days before you get paid. But it depends on when the payment is deposited into your employer’s bank and how fast they process the payment.

Where Can I Add Money To My Chime Card?

You can add money to your Chime card at select retail locations such as Walgreens, CVS, Family Dollar, and 7-Eleven. You can also add funds to your card through direct deposit and bank transfers.

Some retailers offer cash deposits at no fee, while others charge a fee per transaction. It is always best to check with the retailer ahead of time.

Did CChime forget the Password? How To Recover It?

If you’ve lost access to your Chime account password, you can regain it quickly. There are several ways to do it, including the official Chime website and mobile application.

Also Read: Best VWT-Rocc Reviews 2023 – Is It Worth Buying A VW T-Roc?

Using the Chime app, you can also set up two-factor authentication to make your login process safer.

Once you’ve done that, follow the directions to reset your Password.

To do this, log in to the Chime website with your registered email address and the last four digits of your social security number. Once you’ve confirmed your identity, Chime will send you a password reset link to your email. After that, you can sign in again using your new Password.

How Long Does Chime Take To Deposit A Check?

Chime is a mobile-first fintech bank that claims to be changing how people feel about banking. It offers no monthly fees and keeps other charges to a minimum.

The company offers two-day interest-free advances on paychecks, IRS refunds, and government stimulus checks. It also does not check credit reports before making new members.

However, the company’s claim of delivering these deposits two days early may not always be accurate. Direct deposits can be late if processed on a weekend or holiday.

Depending on the source of the check, it can take between three and five business days to clear. This includes bank transfers initiated through the Chime app or website, cash transferred through Green Dot, and returns on the merchandise.

How To Close Chime Account?

You can close your Chime account in a few easy steps. However, you must ensure you’ve completed all other statements linked to your Chime account.

This includes subscriptions you’ve signed up for or payments you set up to transfer funds into your Chime account automatically.

If you’ve tried closing your Chime account and it hasn’t worked, it might be because of some tiresome transactions.

If you have any questions about the process, you can contact Chime customer support. They will be able to provide you with more information and help you get your account closed.

People Also Search

- What Is Chime?

- What Is Chime Customer Service Number?

- What Is Chime Routing Number?

- What Is Chime Meaning?

- How Does Chime Work?

- Chime App Downloading Method Where To Find It?

- Does Chime Work With Zelle?

- Is Chime A Good Bank?

- Is Chime A Prepaid Card?

- Dose Chime Business Account Is Good?

- Is Chime Online Banking Safe?

- What Is Chime Withdrawal Limit?

- Does Chime Show Pending Deposits?

- How To Add Money To Chime Card?

- Is Chime Mobile Check Deposit Instant?

- What Time Does Chime Mobile Deposit Hit?

- Where Can I Add Money To My Chime Card?

- Did Chime forget the Password? How To Recover It?

- How Long Does Chime Take To Deposit A Check?

- How To Close Chime Account?

- Chime Bank Bad Reviews

- Is Chime Safe

- How Does Chime Work

- How Does Chime Make Money

- Chime Credit Card

- The Bancorp Bank Chime

- Chime Bank Name And Address

- Chime Bank Locations